Keystone effect on entry into two-sided markets: An analysis of the market entry of WiMAX

Published in Technological Forecasting and Social Change, 2015

Recommended citation: Kang, J.-S., & Downing, S. (2015). "Keystone effect on entry into two-sided markets: An analysis of the market entry of WiMAX." Technological Forecasting & Social Change, 94, 170–186. http://www.sciencedirect.com/science/article/pii/S0040162514002789

Abstract

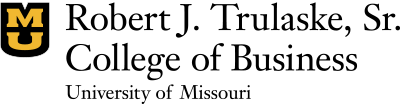

We investigate a market entry scenario where a technologically-superior new platform may overcome its installed base disadvantage with the backing of a strong keystone species advantage within the business ecosystem, called keystone effect in this study, over an incumbent in a market that exhibits indirect network effects. The strength of the keystone species impacts the availability of complementary goods, which is a key factor for a platform to increase its installed base. This study proposes a dynamic economic model to map a market landscape that shows the internal condition (entrant’s keystone effect) and external conditions (incumbent’s keystone effect and indirect network effects) under which a new platform can successfully enter (i.e., maintain oligopoly or monopoly share) or fail to enter a two-sided market in a winner-take-all scenario. We then illustrate the model’s applicability by examining the entry of Worldwide Interoperability for Microwave Access (WiMAX) into the global mobile telecommunications market, employing recent market data from 2009 to 2012 as well as forecast scenario data from 2010 to 2014. In both the historical data and hypothetical forecast scenario we find that WiMAX’s keystone effect disadvantage and the market’s indirect network effects were cumulatively strong enough to prevent the new technology standard from successfully competing with the incumbent (cellular 3G and Long Term Evolution) for oligopoly or monopoly share in the long run.